As is our custom, this semiannual correspondence is intended to keep you abreast of developments in estate and elder law. The following is a brief summary of noteworthy developments since our last communication:

As is our custom, this semiannual correspondence is intended to keep you abreast of developments in estate and elder law. The following is a brief summary of noteworthy developments since our last communication:

Nursing Home Costs Skyrocket

We are regularly seeing nursing home costs that far exceed the published average rate for the State of Michigan. Rates of $9,000 to more than 14,000 per month per person are now the norm. The rising cost of long term care makes it even more imperative that you plan in advance, update your plan regularly, and call us in the event of an emergency. The financial health of your family depends on it.

As is our custom, this semiannual correspondence is intended to keep you abreast of developments in estate and elder law. The following is a brief summary of noteworthy developments since our last communication:

As is our custom, this semiannual correspondence is intended to keep you abreast of developments in estate and elder law. The following is a brief summary of noteworthy developments since our last communication

Although we’re still working on the finishing touches, we have fully moved our former Farmington Hills location to our new Farmington headquarters.

In this issue:

- Major Changes in VA Rules

- Is your Estate Plan or Will in Place?

- Living Right… and Wrong

- What Happens If I Move Out of Michigan?

P. Mark Accettura

P. Mark Accettura was quoted in the July/August 2018 issue of the AARP Bulletin in an article by Jane Bryant Quinn titled “Juggling Estate Decisions: With a stepfamily, try not to split heirs.” Ms. Quinn also referenced Mark’s book Blood and Money, causing a spike in book sales.

It has been widely reported that Aretha Franklin had no estate plan, not even a Will. While the majority of Americans fail to plan, Aretha’s case cried out for special care. Her eldest child is special needs, and she left substantial assets including a tail of music royalties that will continue for generations. Despite the repeated efforts of her attorney, Aretha refused to act.

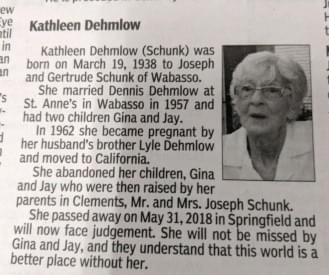

Take the unfortunate case of Kathleen Dehmlow

Studies have shown that relationships with family and friends directly impact the length and quality of our life.

The loving relationships we nurture during life are a gift for your family that is our true legacy. Having a life plan and an up-to-date estate plan make life’s transitions easier and is a statement to your family that you care.

Aid and Attendance is an extremely valuable veterans benefit that is available to veterans and their spouses who are at least sixty-five years of age to assist them with the cost of in-home care, assisted living, and nursing home care. Aid and Attendance is perhaps most beneficial for veterans and their spouses in need of home care and assisted living since no other government program covers such care.

Technically, your Michigan estate plan is valid across the country. However, whether your move is temporary or permanent, you should do new powers of attorney since the rules affecting them can be different from state-to-state.

New powers are advisable even if you maintain your Michigan residency but spend half the year in another state since financial and medical institutions are more likely to honor documents which are familiar to them.

How can you be sure you found all of your late loved one’s life insurance and annuities?

This problem has long vexed Michigan families. Many life insurance policies are hard to find since they are paid-up, or relate to former employment for which there may be no “paper trail.”

Happily, effective in late 2016, the Michigan Department of Insurance and Financial Services (DIFS) implemented the Life Insurance Annuity Search Service (LIAS) program. The new service helps families find life insurance and annuity contracts purchased in Michigan.

Under the common-law rule against self-settled trusts, an individual traditionally could not create a self-settled trust (that is, an irrevocable trust from which he or she could benefit) and protect trust assets from claims of creditors. With the passage of the Qualified Dispositions in Trust Act, Michigan now authorizes the creation of DAPTs to do exactly that.

The Act allows a person to create an irrevocable trust, retain an interest in that trust, and keep his her future creditors from getting to the assets of the trust. DAPTs do not protect assets from all creditors. Under the Uniform Fraudulent Transfer Act, a transfer to a DAPT is fraudulent and can be set aside if the disposition was made with actual intent to hinder, delay, or defraud any creditor of the debtor. In addition, the assets in a DAPT are not protected in a divorce action if the assets were transferred to the trust 30 days or less before the marriage. DAPT laws have been enacted in a 17 states including Michigan.