Since 1787 dower has provided wives (but not husbands) with a one-third life interest in their husband’s real property.

Even after women were allowed to own property in Michigan in the mid-1800s, the state legislature felt that women were still not on equal economic footing with men. Dower remained to prevent a husband from disinheriting his wife by transferring property without his wife’s consent; giving rise to the requirement that a wife must sign all real estate deeds made by her husband even if her name was not on the property.

The VA (Veterans Administration) and Medicaid landscape is ever changing, and always in favor of government. We wrote you last year to advise you of the pending 36-month look-back for VA Aid and Attendance.

The new rules would impose a 36-month look back and penalty period for transfers made by individuals applying for Aid and Attendance benefits. The simple solution is to divest excess assets prior to the effective date of the proposed bill.

That is the million dollar question! Proposals have already been floated that would dramatically change the estate and elder law landscape.

New laws would eliminate the federal estate tax (currently the exemption is $5.4 Million), turn Medicaid (the program that covers indigent health care and long term nursing home care) over to the states in a capped block-grant arrangement administered by each state.

We are also likely to see cost-cutting changes to health care, Medicare and Social Security.

More and more of our business and personal interactions are conducted online. We expect that our online communications are private; less so for social media than for, say, online banking.

What happens to these accounts if we get sick or die? How do our fiduciaries access the information necessary to pay bills or settle our estate?

The Michigan legislature addressed these issues in late 2015 with passage of the “Fiduciary Access to Digital Assets Act.” Under the Act, each of us may authorize our “fiduciaries” (the agent in our power of attorney, personal representative in our will, and trustee in our trust) to interact with our digital custodians.

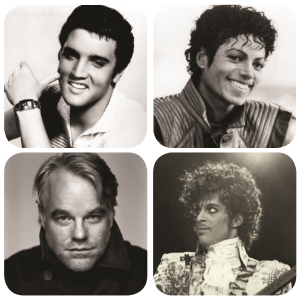

The death of a celebrity, especially when it is sudden, captures our imagination.

We want to know how they died and, of course, what will happen to their money. To us at Accettura and Hurwitz, these deaths are a reminder of the importance of maintaining a current estate plan. An estate plan is part of your final legacy. It is your final statement as to who is loved and important. In it you provide and protect your loved ones; important objectives no matter how much or how little you have. The one thing all of these celebrities had in common is that they either didn’t have an estate plan or it was sadly outdated.

In this issue:

- Is Your Estate Plan In Order?

- What Happens To My Estate Plan If I Get Divorced?

- We're In Our 70s, Should We Get Married?

- How Does My Family Access My Digital Assets?

- Veterans Benefits Update

News About Us

As is our custom, this semiannual correspondence is intended to keep you abreast of developments in estate and elder law. The following is a brief summary of noteworthy developments since our last communication:

The VA and Medicaid landscape is ever changing, and always in favor of government. We wrote you last fall to advise you of the pending 36-month lookback for VA Aid and Attendance. The new rules would impose a 36-month look back and penalty period for transfers made by individuals applying for Aid and Attendance benefits.

The simple solution is to divest excess assets prior to the effective date of the proposed bill. The preferred method is to transfer assets to an asset protection trust outside the name of the veteran and the veteran’s spouse (if any). Funding an asset protection trust would also start the clock running on the current five-year Medicaid look-back.

On balance, the answer is “no.” Once married, both spouse’s assets must be counted for purposes of Medicaid eligibility. It is better to live in sin. However, as love does not have an age limit, many couples decide to marry despite the legal and financial consequences. We recommend those couples enter into a prenuptial agreement and maintain separate trusts. By doing so, they can minimize potential conflict in the event of death or divorce. However, as Medicaid and other government benefits do not recognize prenuptials or the separate titling of assets, the couple should also be prepared to divorce in the event that one of them needs long term care.

It is important that each spouse revise his or her estate plan after divorce. While divorce automatically revokes spousal rights under a will, trust, and powers of attorney, it invariably leaves a void with respect to who is in charge and who inherits. Under Michigan law, a divorce decree revokes the authority granted to a former spouse (and their relatives, other than children of the marriage) and terminates their right to inherit. Unless a new estate plan is created, the probate court will determine the deceased or disabled spouse’s fiduciaries and heirs.